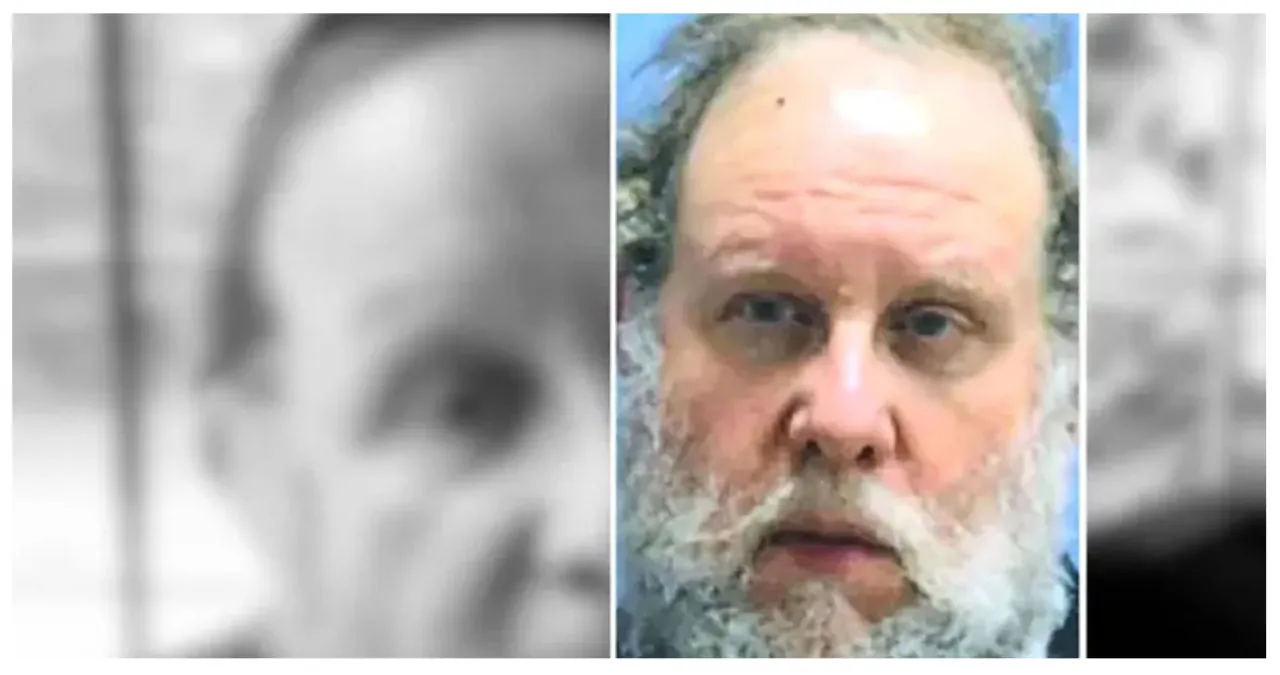

Aiexpress – Joseph Schwartz, a 64-year-old resident of Suffern, was the owner of Skyline Management Group. This company, headquartered in Wood-Ridge, operated a total of 95 nursing homes spread across 11 states.

Hudson View Care & Rehab Center in North Bergen, Brookhaven Health Care Center in East Orange, and the Voorhees Care & Rehabilitation Center were previously part of the list.

In a span of just seven months, starting from October 2017, Schwartz deliberately held back $38.9 million that he was supposed to remit to the IRS as taxes on his approximately 15,000 employees, as revealed by U.S. Attorney for New Jersey Philip R. Sellinger.

According to the U.S. attorney, Schwartz neglected to fulfill his obligation as the administrator of the Skyline 401K plan by not submitting the required annual Form 5500 financial report for the year 2018 to federal authorities.

Authorities have charged Schwartz with stiffing vendors, utilities, landlords, and even his staff. They claim that he redirected the profits generated by Skyline into a series of shell companies that were essentially nonexistent.

The company quickly started losing money and eventually collapsed, leaving the care of 7,000 residents and the futures of the employees uncertain, according to investigators.

States took action to address the situation by shutting down certain facilities, placing others under receivership, or finding new operators to manage them. Unfortunately, this resulted in employees and vendors being left unpaid during the process.

Schwartz, on the other hand, emerged as a prominent figure for advocates who were calling for increased scrutiny of individuals seeking nursing home licenses.

Arkansas authorities have accused Schwartz of overbilling Medicaid for a staggering $3.6 million. Similarly, their counterparts in Nebraska have levied charges against him, his wife, and the company for an astounding $60 million worth of Medicaid fraud.

Schwartz and his businesses faced civil suits in multiple states.

In a federal court in Newark, a group of former employees has filed a lawsuit against Schwartz, alleging that he misappropriated over $2 million from their payroll deductions. These deductions were meant to contribute to their health insurance coverage. As a result, many of them found themselves saddled with unexpected medical expenses, amounting to tens of thousands of dollars.

On January 17, he pled guilty in federal court in Newark to the charges of willfully failing to pay over employment taxes withheld from his company’s employees and willfully failing to file the annual Department of Labor financial report for the employee 401K benefit plan.

The sentencing for May 22 has been scheduled by U.S. District Judge Susan D. Wigenton. Schwartz, who is currently free on a $2 million bond secured by his house, will remain so until then.

Special agents from the IRS-Criminal Investigation, investigators from the Department of Labor-Employee Benefits Security Administration, and FBI agents were credited by Sellinger for their role in the investigation. Assistant U.S. Attorney Kendall Randolph from the Criminal Division in Newark and Trial Attorney Shawn Noud from the Justice Department’s Tax Division secured the guilty plea.