ai express – Homeowners in Washington County are expressing their frustration with State Farm due to conflicting assessments for hail damage after a storm in 2023. Contractors are at odds with the insurance company over the extent of the damage, causing further aggravation for the affected homeowners.

Last year, severe weather wreaked havoc in Washington County, leaving some families with a costly predicament. When insurance companies and home contractors fail to reach a consensus, it’s the consumers who bear the financial burden.

On April 19, 2023, a barrage of severe thunderstorms unleashed golf ball-sized hail and torrential rain. Nicole and John Maziasz of Jackson bravely ventured outside to assess the aftermath.

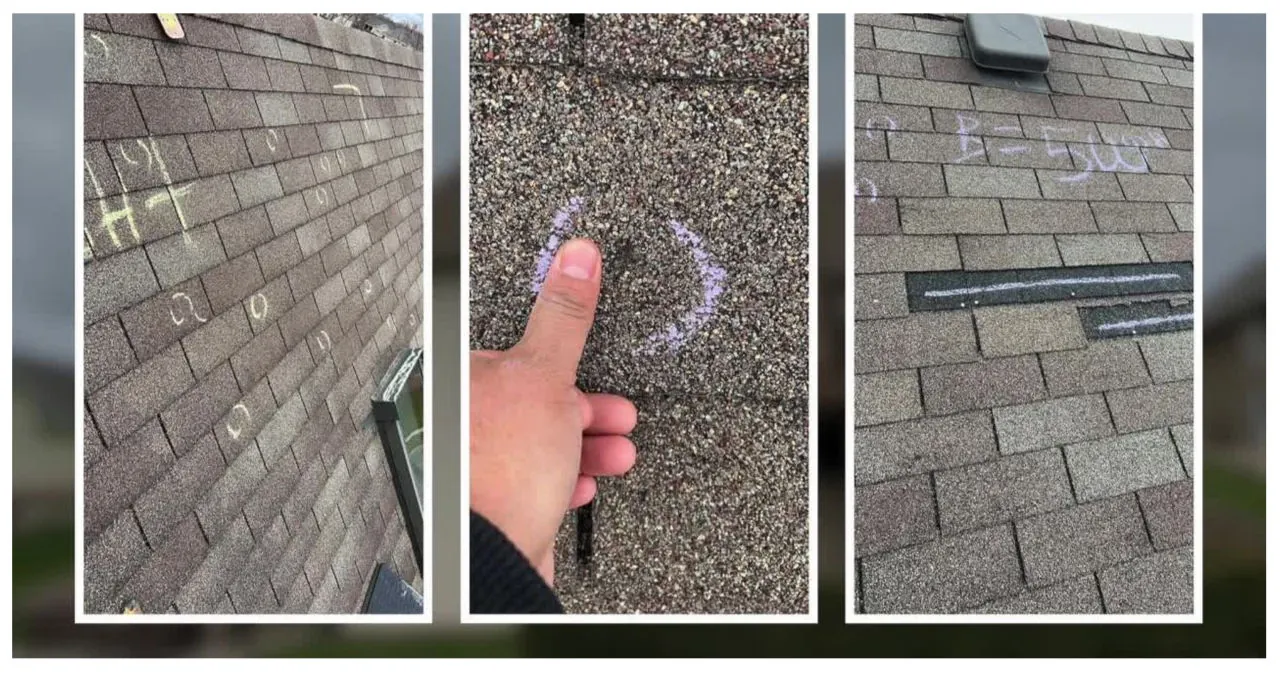

Nicole Maziasz noticed that the back patio was covered in granules.

Get daily headlines and breaking news emails from FOX6 News by signing up today.

The granules on the roof’s shingles caught the family’s attention. Concerned about possible damage, they reached out to a trusted contractor to assess the situation.

According to Nicole Maziasz, when he went up on the roof, he immediately recognized the damage as hail damage.

April 19, 2023 Storm Leaves Devastation in its Wake

The storm that hit on April 19, 2023, left behind a trail of destruction and devastation.

The Jackson couple mentioned that State Farm had dispatched its own adjuster, who concurred with their contractor.

Nicole Maziasz remembered the adjuster saying, “Yes, it’s exactly what you would expect in a two-hour storm.”

The State Farm adjuster decided not to walk the back half of their roof, citing its steepness as a reason. However, the Maziasz family reported that State Farm sent another adjuster who arrived at a different conclusion regarding the condition of their roof.

Nicole Maziasz recalls that when he came down, he assured them that there was no damage. He mentioned that they might be dealing with a possible manufacturer shingle defect.

Nicole and John Maziasz, along with three other families, recently reached out to Contact 6 to share their frustrating experiences with State Farm. They claim that the insurance company either underestimated the extent of roof damage caused by spring hail storms or outright denied their claims. Local contractors who assessed their roofs confirmed that there was indeed significant hail damage.

“I rarely find myself getting angry, but State Farm’s decision managed to provoke that emotion within me,” admitted John Maziasz.

The Maziasz family received a quote of $31,000 for hail damage repair and roof replacement from a single company. However, State Farm only identified $700 worth of damages.

Read more: Alabama County Actively Seeking Residents with Outstanding Warrants: Volume 4

According to a spokesperson from State Farm, the company aims to ensure that their customers receive all the benefits they are entitled to under their insurance policy.

Nicole and John Maziasz’s roof in Jackson bears the unmistakable marks of hail damage.

State Farm sent the Maziasz family a letter six months after the storm, stating that the condition of their roof shingles had deteriorated to such an extent that it needed to be replaced. The letter also mentioned that if the roof was not replaced, their insurance policy would not be renewed.

State Farm has received almost 3,500 catastrophe claims in Wisconsin, excluding auto, since last spring. In the state, they have paid out nearly $50 million.

According to Scott Holeman from the Insurance Information Institute, insurers have experienced unprofitable years for homeowners insurance in four out of the last five years. As a result, premiums are steadily increasing.

“We are witnessing an increase in devastating losses caused by severe weather,” stated Holeman.

State Farm, one of the leading insurance companies, has paid a staggering $3.5 billion in hail damage claims in 2022. Wisconsin, in particular, has witnessed significant damage, ranking sixth in the nation with a total of $194 million in claims paid. In the year 2023, State Farm continued to provide support, allocating approximately $60 million specifically for catastrophe claims in Wisconsin.

State Farm hail damage claims in 2022

According to a spokesperson from State Farm who spoke with Contact 6, the decrease in claims in 2023 compared to 2022 can be attributed to a reduction in severe weather occurrences in Wisconsin. They mentioned that State Farm had to respond to seven severe weather events in Wisconsin in 2022, whereas the number dropped to three in 2023.

Insurers are also grappling with rising expenses for home construction and repairs, according to Holeman.

Holeman expressed that society, as a whole, does not support insurance companies covering unnecessary expenses as it can lead to increased prices for everyone involved.

In 2022, the Wisconsin Office of the Commissioner of Insurance received a total of 38 homeowner insurance claim complaints regarding roof and hail damage. Out of these complaints, State Farm accounted for the highest number with 21 complaints, making up approximately 55% of the total. Following closely behind was Allstate, which received six complaints, accounting for about 16% of the total complaints.

If you need to submit an inquiry, it’s important to know the proper process and what information you should provide. Here are the steps you should take and the details you should include when submitting an inquiry:

1. Start by gathering all relevant information: Before submitting your inquiry, make sure you have all the necessary details at hand. This may include your name, contact information, account number (if applicable), and a clear description of the issue or question you have.

2. Choose the appropriate channel: Determine the best method for submitting your inquiry. This may vary depending on the organization or company you are contacting. Common channels include email, phone, online contact forms, or even in-person visits.

3. Follow any specific instructions: Some organizations may have specific guidelines or requirements for submitting inquiries. Take the time to familiarize yourself with these instructions and ensure you comply with them. This can help streamline the process and ensure your inquiry is handled efficiently.

4. Craft a clear and concise message: When writing your inquiry, be sure to clearly state your issue or question. Provide all relevant details and avoid unnecessary information that could confuse or distract from your main point. Remember to use a polite and professional tone throughout your message.

5. Proofread and edit: Before submitting your inquiry, take a moment to proofread and edit your message. Check for any spelling or grammar errors, and ensure that your writing is clear and easy to understand. This can help convey your message effectively and make a positive impression.

6. Submit your inquiry: Once you are satisfied with your inquiry, submit it through the appropriate channel. Be sure to double-check that you have included all necessary information and that your contact details are accurate. If possible, keep a record of your submission for future reference.

By following these steps and providing all the necessary information, you can increase the chances of getting a timely and helpful response to your inquiry. Remember to be patient and follow any further instructions or communication from the organization or company you are contacting.

Don and Donia Groves of Hartford experienced hail damage to their roof during the storm on April 19, 2023. Several contractors provided the Groves with estimates for the repairs, which amounted to approximately $20,000 or more.

According to Don Groves, a contractor expressed confidence in their claim for a roof replacement, describing it as “a slam dunk.” Initially, State Farm issued a check amounting to $6,087 to the Groves. However, after reevaluating the situation, the insurance company revised their estimate to $9,860. The Groves have yet to cash the check.

Groves expressed his growing frustration as he observed his neighbors receiving new roofs on both sides of his house and across the street. He couldn’t help but feel left out and wondered why he hadn’t been able to get a brand-new roof for his own home.

The Maziasz family also experienced this sentiment. Throughout the entire summer, Nicole Maziasz could hear her neighbors undergoing roof replacements.

Don and Donia Groves’ roof in Hartford bears the markings of hail damage.

Nicole Maziasz expressed her frustration with the daily morning sound of tap-tap-tap, finding it incredibly distressing.

State Farm informed both families that there was some damage to the soft metal. According to them, State Farm provided varying explanations for the cause of the roof damage, including roof blistering, erosion, and trapped moisture, rather than attributing it to hail.

According to a spokesperson from State Farm, hail damage coverage is typically included in a homeowner’s policy, although each claim is evaluated independently based on its own merits.

Both the Maziasz and Groves families lodged complaints with the Wisconsin Office of the Commissioner of Insurance. However, upon investigation, the agency did not discover any wrongdoing on the part of State Farm in their handling of the claims. As a result, the families are now contemplating taking legal recourse.