The initiative to repeal the 2021 tax on income generated from the sale of capital gains has been certified by the Washington Secretary of State’s Office. If approved by voters in November, this initiative would effectively eliminate the tax.

Initiative 2109 aims to abolish a recently enacted law by the Legislature, which imposes a 7% tax on long-term capital gains exceeding a specific threshold. The state Supreme Court had upheld this tax following a legal challenge last year. Moreover, the U.S. Supreme Court declined to hear a federal lawsuit claiming that the tax violated the Commerce Clause of the U.S. Constitution.

State Representative Jim Walsh, a resident of Aberdeen, filed the initiative, and Let’s Go Washington, a voter advocacy group, led the signature gathering effort.

In a press release, the organization’s founder, Brian Heywood, expressed his belief that the income tax on capital gains does not align with the law or the wishes of the voters. According to Heywood, this tax is seen as a gateway to implementing a statewide income tax. Furthermore, he claims that there are already plans to broaden the tax and focus on a larger group of individuals, including small business owners, family farms, entrepreneurs, and restaurant owners. Heywood asserts that it is necessary to permanently close this door.

Misha Werschkul, Executive Director of the Washington Budget and Policy Center, expressed their support for the certification of the initiative. They emphasized that advocates have been working tirelessly for over a decade to implement this sensible policy, recognizing the crucial role of the tax code in promoting racial and economic justice. Werschkul also highlighted that I-2109 is seen as another tactic employed by the ultra-wealthy to evade their tax obligations.

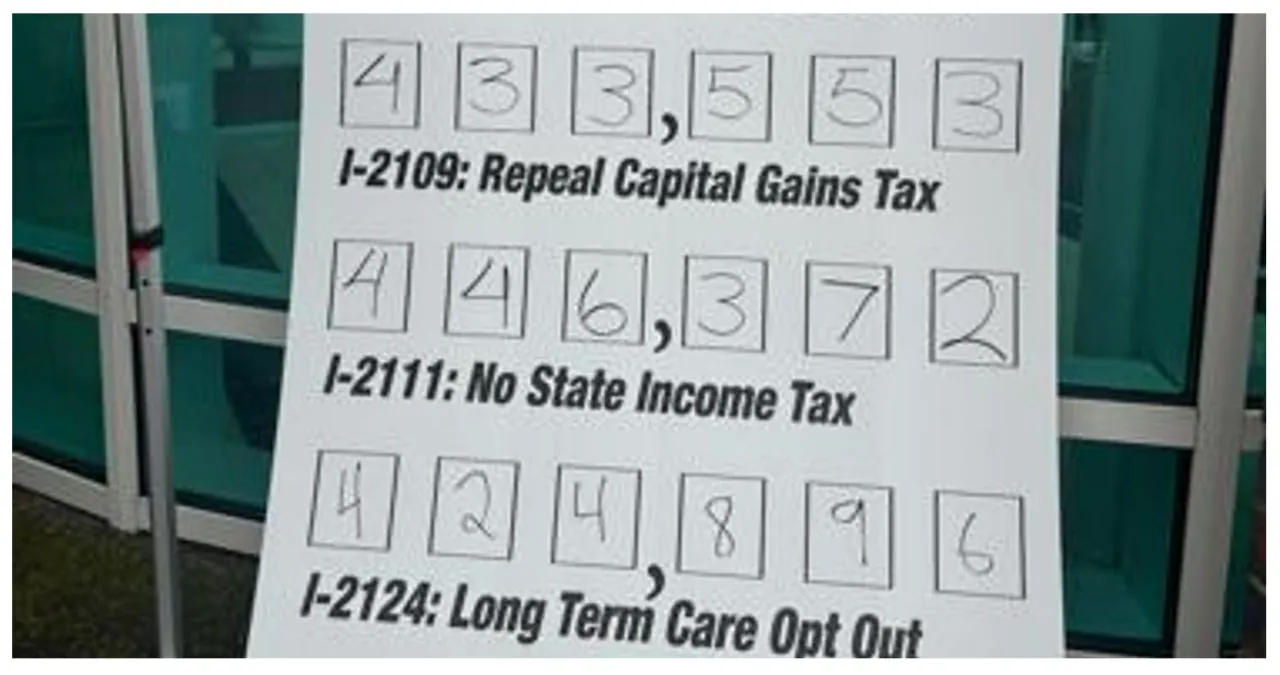

Let’s Go Washington has also submitted signatures for several other initiatives that would:

The proposed measures aim to restore the state law on police vehicular pursuits, repeal the cap-and-trade program, grant parents and guardians the right to review educational materials and receive notifications, allow certain individuals to opt out of the mandatory long-term care tax, and eliminate any income tax in Washington.

Read More:

- Texas Senator John Cornyn, 71, Expresses Concerns over Unprecedented Dangers to American Citizens, Following Biden’s Controversial Statement

- Colorado Man Allegedly Opened Fire on Police with an Arsenal Featuring Multiple Guns and Ballistic Vests, Authorities Say