A couple was left in utter disbelief when they discovered that their bank account had been completely emptied of a substantial amount of money while they were at a gas station.

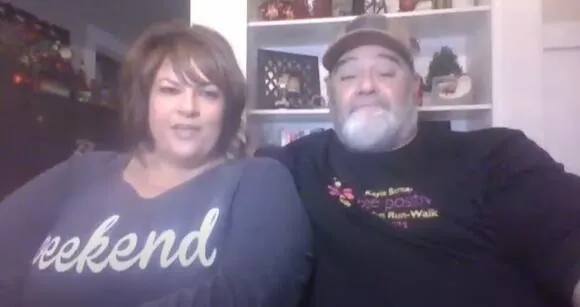

Sean Franck and Kristin Bettencourt were filled with panic and shock when they stumbled upon their account balance, which was in the negative.

“It’s not fair,” Sean exclaimed. “I have always worked tirelessly for everything I have, and so has she.”

During their weekend getaway in Turlock, California, the recently engaged couple stumbled upon an unexpected find.

Elaine revealed that our account was in the negative when Sean checked it.

“We were in a state of panic, and that’s when we had to take immediate action and contact the bank to mitigate the damage.”

“We lost thousands of dollars as our account was completely emptied.”

Sean expressed his frustration, stating, “It’s unbelievable that someone would completely empty our account without any clear motive.”

“It’s absolutely revolting.”

There is a belief that the two individuals were victims of credit card skimming.

Kristin mentioned that it is highly probable that our card was skimmed by a card reader at a gas station or any retail store.

According to our understanding, it seems that they created a duplicate of his card and managed to successfully utilize it in two separate states.

According to experts, the fraudulent method exhibits a high degree of organization.

Brad Leopard, a special agent with the U.S. Secret Service, described the operation as a comprehensive and large-scale endeavor.

“There are three main groups involved in this operation. First, you have the individuals responsible for manufacturing the devices. Then, there is a team hired to install these devices in stores. Finally, you have the individuals who handle the cashing out process, known as the money mules.”

Technology has the ability to enhance safety and improve various aspects of our lives.

Criminals also find it easier to navigate through these advancements, constantly seeking new avenues to exploit.

“They always find a way to do it, no matter how many obstacles we put in their path.”

According to the FBI, card skimming costs consumers over a billion dollars annually.

Sean and Kristin have been informed by their bank that they will have to wait for a period of 10 days in order to receive reimbursement for their lost funds.

Sean was filled with anger as he said, “Just imagine if someone was doing this to your mom, grandmother, or sister.”

“We all have our roots and connections to others, regardless of our identities.”

According to Dominique Sanchez, spokesperson for the Turlock Police Department, there have been a total of 35 skimming reports this year. The majority of these incidents occurred in the months of September and October.

Authorities are advising people to utilize indoor ATMs, ensuring they cover the PIN pad while inputting their information and opting for contactless transactions whenever feasible.

More News:

- In California’s sensitive locations, the battle over concealed weapons law heats up

- In a Mojave car crash, a woman dies and two mens are hospitalized